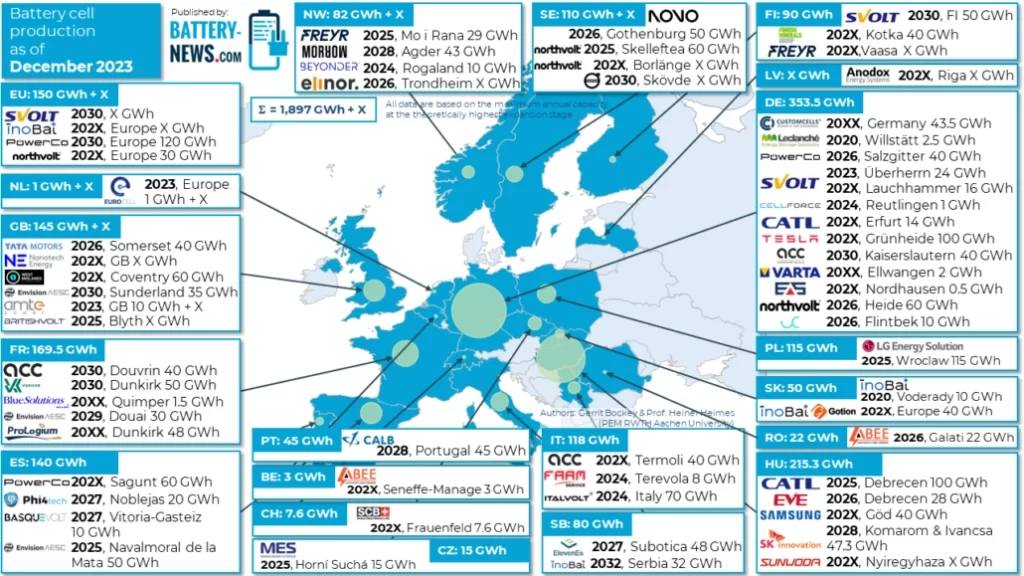

With battery-electric vehicles (BEVs) constantly gaining market share in Europe and states like France now only subisdising BEVs built on the Old Continent, there’s increasing pressure on the local battery cell industry. And the segment’s massive expansion plans can be seen on a map detailing battery cell factory projects in Europe, as of December 2023.

This map showcases the current take on planned and already implemented projects in the field of lithium-ion battery production in Europe. Most of the listed production sites’ innauguration dates range from 2024 (e.g., Beyonder’s 10 GWh site in Rogaland, Norway) to 2030 (Envision AESC’s 35 GWh site in Sunderland, UK).

However, it also includes facilities whose operational date has yet to be published, such as Tesla’s 100 GWh site in Germany (202X) and Prologium’s 20XX site in Dunkirk, France.

The map was released by Battery News Germany. It was created by Gerrit Bockey and Professor Heiner Heimes at Germany’s RWTH Aachen University. It features data based on the maximum annual capacity of the production sites (at the theoretically highest expansion range).

Thhe top ten countries leading Europe’s battery cell factory expansion are Germany (353.5 GWh), Hungary (215.3 GWh), France (169.5 GWh), Great Britain (145 GWh), Spain (140 GWh), Hungary (215.3 GWh), Italy (118 GWh), Poland (115 GWh), Sweden (110 GWh + X) and Finland (90 GWh). For the entire continent, we’re looking at a capacity of 1,897 GWh, plus that of the sites whose operations start date hasn’t been released yet.

Electrified vehicle sales in Europe, 2023

According to data from the European Automobile Manufacturers’ Association (ACEA), battery-electric vehicles (BEVs) had a market share of 14.2% between January and November. Hybrids now make up 25% of the market, but with this category including both hybrids and mild-hybrids (48V), which are not considered zero-emission vehicles by the EU, this statistic isn’t what it appears. As for plug-in hybrid electric vehicles (PHEV), these accounted for 3% of the sales.

All in all, electrified vehicles had a market share of 42.2% in Europe between January and November 2023. It’s worth mentioning many battery production facilities in Europe supply more than one of the vehicle cattegories mentioned above.

Examples include Northvolt Ett in Sweden, which makes batteries for Volvo Polestar and Renault while covering both EVs and PEHVs, as well as CATL Brindisi in Italy, which produces batteries for Stellantis EVs and PHEVs. Then there’s LG Energy Solution in Lithuania, which builds batteries for the Renault Zoe and Dacia Sping EVs and also covers HEVs.

As far as automakers go, there are companies like Tesla and VW who have their own battery factories, while others, such as BMW, work with multiple suppliers.

And here’s the EV battery factory map for North America, so you can see how some of the carmakers above are doing across the pond—interestingly, the overall annual production capacity is smaller than that projected for the Old Continent by 2030.